Understanding Property Tax Deadlines and Consequences

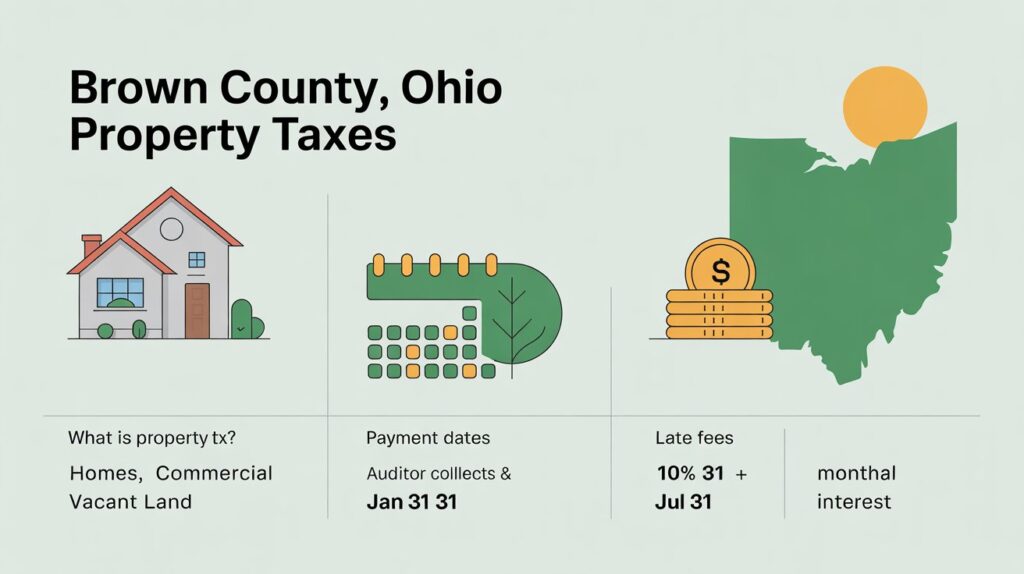

Property taxes are a fundamental part of owning real estate inBrown County, Ohio. These taxes support essential local services such as schools, emergency response, public infrastructure and community programs that directly benefit residents. Equally important is knowing when your property taxes must be paid and what penalties may apply if a payment is missed.

This guide provides a clear, practical overview of Brown County property tax deadlines, potential penalties, and strategies to manage or resolve late payments efficiently.

Understanding Property Tax in Brown County

Property tax is a local levy imposed on real estate, including residential homes, commercial properties, and vacant land in Brown County, Ohio. The Brown County Treasurer’s Office is responsible for collecting these taxes, which are typically paid in two installments each year. Missing a payment can result in penalties and accruing interest, making it crucial for property owners to stay informed about deadlines.

Property taxes are determined based on the assessed value of each property combined with the local millage rate, which is influenced by various levies and school districts. The Brown County Auditor’s Office conducts property assessments, while the Treasurer’s Office handles billing, collection, and record-keeping.

Brown County Property Tax Due Dates

In Brown County, property taxes are generally split into two payments annually. Homeowners receive the first half of the tax bill in December, with a due date in the following January, and the second half is billed in June, due in July.

| Installment | Typical Due Date | Example Year |

|---|---|---|

| First Half Tax | January 31 | 31 January 2025 |

| Second Half Tax | July 31 | 31 July 2025 |

Note: Exact due dates may vary slightly each year depending on when tax bills are issued by the Brown County Treasurer.

While these are standard deadlines, the exact dates can vary slightly each year. The Treasurer’s Office announces official due dates via tax bills, local newspapers, and the Brown County official website ahead of each collection period.

Paying property taxes on or before the due dates helps property owners avoid additional penalties and interest charges.

Penalty for Late Payment

If property taxes are not paid on time in Brown County, penalties are automatically applied. The county uses a structured two-tier system:

- Initial Late Payment Penalty: A 10% penalty is imposed on the unpaid portion of the tax immediately after the due date.

- Monthly Interest on Unpaid Balance: An additional 1% interest accrues on the outstanding balance each month until the payment is fully settled.

Example:

For a property tax bill totaling $2,000, missing the January or July deadline would result in an immediate $200 penalty (10%). If the bill remains unpaid for another month, an extra 1% interest would be added to the remaining balance.

Why Property Tax Penalties Exist

Property tax penalties in Brown County exist to encourage timely payments and ensure the county can fund essential community services reliably. Revenue from property taxes supports public schools, emergency services, local infrastructure maintenance, and other programs that benefit residents directly.

Late or missed payments can disrupt these funding schedules, which is why penalties are enforced. The goal is not to punish property owners but to maintain a consistent and fair flow of revenue, ensuring that all residents contribute equitably to community services.

What to Do If You Miss the Due Date

If you have missed a Brown County property tax deadline, several steps can help you minimize additional penalties and interest:

- Pay as Soon as Possible: The longer a payment is delayed, the more interest accrues. Prompt payment reduces further financial impact.

- Request a Penalty Waiver: In specific situations such as illness, unexpected financial hardship, or administrative errors beyond your control, property owners can submit a written request to the Brown County Treasurer’s Office for a penalty waiver. Approval depends on the justification and supporting documentation provided.

- Set Up a Payment Plan: The Treasurer’s Office may allow a short-term installment arrangement, enabling property owners to gradually pay overdue taxes. This approach prevents additional interest accumulation and protects the property from potential tax foreclosure.

- Pay Online for Convenience: Brown County residents can make secure, fast payments online through the official Brown County Treasurer’s website. Using online payment options helps avoid missing future deadlines and keeps your payment records organized.

Who Must Pay and When It Applies

Property tax responsibilities in Brown County apply to all owners of real estate, including:

- Residential property owners

- Commercial property owners

- Industrial property owners

- Owners of vacant or undeveloped land

Certain exemptions may reduce or eliminate property tax obligations

These include the Homestead Exemption for senior citizens or disabled homeowners, as well as exemptions for qualified nonprofit, religious or government-owned properties. Property owners should consult the Brown County Auditor’s Office to determine eligibility for any applicable exemptions.

When Property Tax Updates Occur

The Brown County Treasurer updates property tax schedules and penalty rules twice annually:

- December: Updates for the first-half tax period

- June: Updates for the second-half tax period

Always rely on the most recent tax bill for official deadlines

These updates account for changes in property assessments, millage rates, and any newly approved local levies. Homeowners are encouraged to review their official tax bills or visit the Brown County Treasurer’s website to access the most current and accurate information.

How to Avoid Penalties in the Future

- Mark property tax due dates on a calendar or set digital reminders.

- Sign up for email or text alerts through the Treasurer’s Office.

- Use online payment options to ensure timely payment rather than relying on paper bills.

- Confirm that your property’s mailing address and contact information are up to date to avoid missing notices.

Consider setting up AutoPay if available By taking these proactive measures, Brown County property owners can avoid unnecessary penalties, stay organized and manage their tax obligations efficiently.

Conclusion

Understanding Brown County’s property tax deadlines and penalty structure is crucial for every property owner. Timely payment not only helps you avoid financial penalties but also ensures consistent funding for schools, emergency services, infrastructure and other vital community programs.

If you fall behind on payments, act promptly contact the Brown County Treasurer’s Office, request guidance or assistance if needed, and explore available payment options. Staying informed and proactive enables property owners to manage their taxes responsibly, avoid penalties, and maintain good standing with the county. Checking due dates early each year is the simplest way to protect your property and avoid unnecessary costs.

FAQs

When are Brown County property taxes due?

Typically, the first half is due by January 31 and the second half by July 31 each year.

How much is the penalty for late payment?

A 10% penalty is applied immediately after the due date, with an additional 1% monthly interest on the unpaid balance.

Can I request a waiver for late payment penalties?

Yes, if you have a valid reason such as illness, financial hardship, or an administrative error, you can submit a written request to the Brown County Treasurer’s Office. Approval depends on documentation and justification.

How can I pay my property taxes online?

Payments can be made securely through the official Brown County Treasurer’s website using a credit card, debit card, or bank transfer.

What happens if I don’t pay my property taxes at all?

Unpaid taxes may result in a tax lien or property foreclosure. Prompt payment is strongly recommended to avoid these serious consequences.