If you believe your property in Brown County, Ohio has been overvalued or assessed incorrectly for tax purposes, you have the right to formally challenge it. Property taxes play a critical role in household budgets, and ensuring your assessment is accurate means you pay only your fair share. This comprehensive guide walks you through the step-by-step process to file a property value complaint in Brown County, explains what to expect at each stage and offers practical tips to strengthen your case.

Understanding Property Value Complaints in Brown County

A property value complaint is a formal objection filed with the Brown County Auditor’s office when a property owner believes the assessed value of their property is incorrect. These assessments determine how much you pay in property taxes each year, and challenging an inaccurate valuation ensures fairness and accuracy. Filing a complaint can help you:

- Reduce property taxes if your assessment is too high

- Correct factual errors (square footage, lot size, classification)

- Ensure fair and equal taxation across Brown Count

Brown County Auditor Contact Information

- Phone: (937) 378-6398

- Fax: (937) 378-6038

- Email: jhall@browncountyauditor.org

Step 1: Review Your Property Assessment

Before filing a complaint, gather and examine key information:

- Check your property’s assessed value on the Brown County Auditor website.

- Compare similar properties in your area to see if their assessed values are significantly lower than yours.

- Verify property details in the county records, including:

- Square footage

- Lot size

- Property classification (residential, commercial, agricultural)

This research is essential, as strong evidence forms the backbone of a successful complaint. Accurate well-documented discrepancies increase the likelihood that your request will be considered seriously.

Step 2: Gather Supporting Documentation

Common Supporting Documents:

- Certified professional appraisal reports

- Property photos showing condition or damage

- Comparable sales with lower market values

- Repair estimates or damage records

Organize these documents carefully they should be submitted along with your complaint form to provide a clear, convincing case.

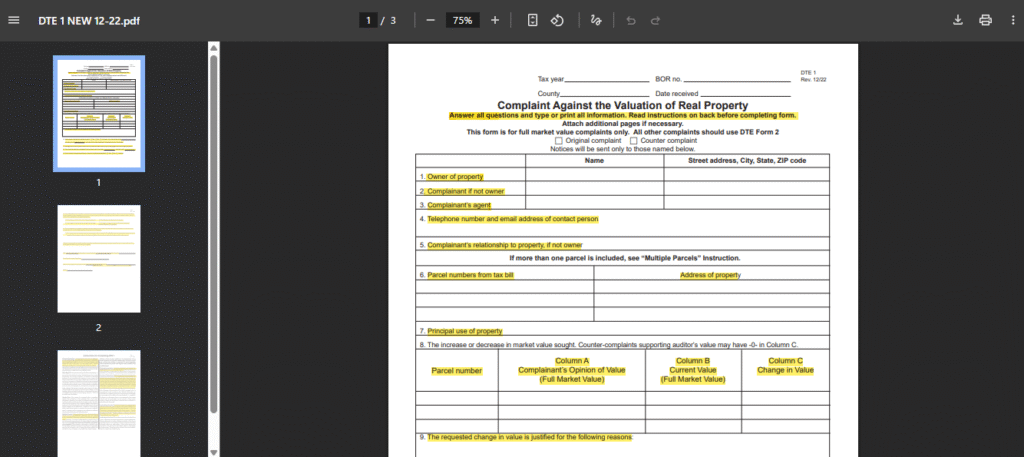

Step 3: Complete the Complaint Form

The Brown County Auditor’s office provides official forms for property value complaints. Common forms include:

- Form DTE 1: Complaint against the Valuation of Property

- Form DTE 2: Complaint against the Assessment of Real Property Other than Market Value

- Form DTE 26: Application for Valuation Deduction for Destroyed or Damaged Property

Instructions for filling out the form:

- Enter parcel number, owner name, and contact details

- List current assessed value and requested value

- Explain the reason for your objection clearly

- Attach all supporting documentation gathered in Step 2

Accuracy is crucial. Errors on the form can delay or invalidate your complaint, so double-check all entries before submission.

Step 4: Submit the Complaint on Time

Meeting deadlines is essential in Brown County. Missing the filing window may lead to an automatic denial of your complaint.

| Submission Detail | Information |

|---|---|

| Filing Period | January 1 – March 31 |

| Submission Methods | In person, mail, online (if available) |

| Proof Required | Receipt, email confirmation, or tracking number |

Brown County Auditor’s Office Address:

800 Mt Orab Pike, Suite 181

Georgetown, OH 45121

Contact Information:

- Phone: (937) 378-6398

- Fax: (937) 378-6038

- Email: jhall@browncountyauditor.org

Step 5: Attend the Board of Revision Hearing

Once your complaint is submitted, the Brown County Board of Revision (BOR) schedules a hearing to review your case.

- You will receive a formal notice with the hearing date, time, and location.

- Present your case clearly, relying on the documentation and evidence collected in earlier steps.

- Answer board questions professionally and provide any additional clarification requested.

- For complex cases, consider consulting a tax professional or attorney to strengthen your position.

The board carefully evaluates all submitted evidence before reaching a decision.

Step 6: Understand the Decision and Next Steps

After the hearing, the BOR communicates its decision in writing:

- Approved complaint: Your property’s assessed value will be adjusted, and taxes recalculated accordingly.

- Denied complaint: You have the right to appeal to the Ohio Board of Tax Appeals within 30 days of the BOR’s decision.

Maintain records of all communications and submissions; they are important for reference in any future appeals or tax matters.

Tips for a Successful Property Value Complaint

- Be thorough, factual, and organized; avoid emotional arguments.

- Use current, comparable property sales to substantiate your claim.

- Document any errors or discrepancies in county records carefully.

- File early to ensure deadlines are not missed.

- For high-value or unique properties, consider a professional appraisal.

Following these tips maximizes the likelihood of a favorable outcome and strengthens your position during the review process.

Conclusion

Filing a property value complaint in Brown County, Ohio is an effective way to ensure fair and accurate property taxation. By systematically reviewing your assessment, gathering credible evidence, submitting your complaint on time, and presenting your case professionally, you can significantly increase your chances of success. Taking these steps not only protects your finances but also promotes transparency and fairness in local taxation, benefiting all residents of the county.

FAQ’s

Who can file a property value complaint in Brown County?

Any property owner or authorized representative who believes the assessment is incorrect.

How long does it take to receive a decision?

Decisions are usually issued within a few weeks after the BOR hearing.

Can I appeal if my complaint is denied?

Yes, appeal to the Ohio Board of Tax Appeals within 30 days.

Is there a fee to file a complaint?

No. Filing a property value complaint in Brown County is free. There are no charges for submitting forms or attending the BOR hearing.

Can I negotiate directly with the Auditor before filing?

Yes, but a formal complaint ensures legal protection.