Property records are official public documents that reveal essential information about any property within Brown County, Ohio. These records typically include ownership details, assessed values, tax history, property transfers, and parcel specifics. Whether you are a current homeowner, prospective buyer, real estate investor, or local researcher, understanding how to access property records from the Brown County Auditor’s office is critical.

This comprehensive guide walks you through the most reliable ways to obtain a property record copy, ensuring you have accurate, up-to-date and complete information to make informed decisions. By following these steps, you can save time, avoid unnecessary errors and confidently navigate property-related processes in Brown County.

Definition and Purpose of a Property Record Copy

A property record copy is an official document maintained by the Brown County Auditor’s Office. This report provides a thorough overview of a specific property, covering critical details such as:

| Record Section | What It Includes |

|---|---|

| Legal Description | Official boundaries and land designation |

| Ownership Details | Current and past owners |

| Property Values | Assessed value and market value |

| Tax History | Past payments, balances, and assessments |

| Transfer Records | Sales history and ownership transfers |

These records serve multiple important purposes. They are used to verify property ownership, calculate accurate property taxes, and support real estate transactions. Additionally, they are a valuable resource for homeowners, buyers, investors and researchers who need precise, official and verifiable property information within Brown County, Ohio.

By accessing a property record copy, users gain a complete and reliable snapshot of a property’s history and current status, ensuring transparency and informed decision-making in all property-related matters.

How to Obtain a Property Record Copy from Brown County Auditor: Step-by-Step Guide

Accessing property records in Brown County, Ohio is straightforward, and most users can retrieve detailed information quickly online or through direct requests. Follow this step-by-step guide to obtain a property record copy efficiently and accurately.

Step 1: Visit the Brown County Auditor Website

Begin by navigating to the official Brown County Auditor website. On the homepage, look for the “Property Search” or “Property Records” section. This section is designed to provide intuitive access to property information for homeowners, buyers, investors and researchers.

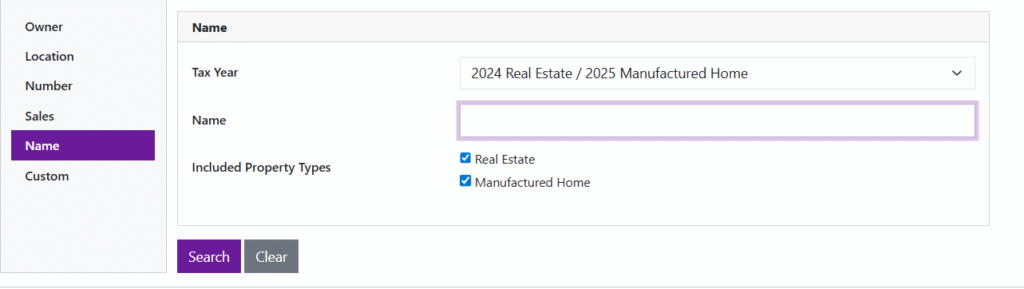

Step 2: Use the Property Search Tool

The property search tool allows you to locate property records using several options:

- Owner’s Name – search by the current property owner’s full name

- Property Address – enter the street address for precise results

- Parcel Number – use the unique parcel ID assigned to each property

Once your search returns results, click on the relevant property to view the complete record, which includes ownership details, assessed value, tax history and transaction records.

Step 3: View, Download, or Print Property Information

After locating your property:

- Review all available details directly on the website

- Download the record as a PDF for personal reference

- Print a copy if a physical document is required

This allows for quick access to information for personal, research, or pre-purchase purposes without visiting the office in person.

Step 4: Request a Certified Property Record Copy

For legal, banking or official purposes, you may require a certified property record copy. In Brown County, this can be requested through the Auditor’s office:

- In-person – visit the Brown County Auditor’s office for immediate assistance

- By mail – submit a request form with required information and fees

- By phone/email – contact the office for guidance on the process, fees, and required documentation

Certified copies are officially notarized and can be used in court, mortgage processing, or formal real estate transactions.

Cost of Property Records in Brown County

The fees for obtaining property documents in Brown County are as follows:

| Office / Department | Form Name | Fee | Purpose |

|---|---|---|---|

| Brown County Auditor | Public Records Request Form | $0.10 per page | To obtain general property information or a property record copy |

| Brown County Recorder | Copy Request (Deed / Certified Copy) | $2.00 per page + $1.00 certification fee | To obtain a certified copy of recorded documents, deeds, or property transfers |

Pro Tip: Always confirm the most current fees and submission requirements directly on the Brown County Auditor or Recorder’s website, as rates and procedures may change periodically.

This guide ensures you can efficiently access and obtain property records in Brown County while understanding your options for official copies, associated costs and submission methods.

Auditor’s Office Address

Brown County Auditor’s Office

800 Mt. Orab Pike, Suite 151

Georgetown, OH 45121

Key Contacts

- Jill M. Hall – Brown County Auditor

- Real Estate & Public Records Staff – Available through the main Auditor’s Office

- General Assistance – Handled by administrative staff during office hours

Office Hours

Monday – Friday: 8:00 AM to 4:00 PM

Contact Information

- Phone: (937) 378-6395

- Fax: (937) 378-2516

- Email: Available through the official Brown County Auditor website’s contact page

Other Ways to Request Property Records

If you prefer not to use the online search system, the Brown County Auditor provides additional ways to access property record copies.

In-Person Requests

You can visit the Auditor’s Office during business hours.

Bring your parcel number, owner name, or property address.

Staff will help you locate and print the record you need.

Mail or Email Requests

You may also request a property record copy by mail or email.

Include:

- Your full name

- Mailing address

- Parcel number or property address

- Whether you need a regular or certified copy

Certified copies may involve a processing fee.

Fees and Processing Time

- Standard copies: $0.10 per page (Brown County Auditor)

- Certified copies (via Brown County Recorder):

- $2.00 per page

- $1.00 certification seal

- $2.00 per page

Expert Tip: If you need a certified property record for purposes such as banking, court, or a real estate transaction submit your request at least 3 business days in advance to avoid delays in processing.

Common Problems with Property Records and How to Resolve Them

1. Incorrect or Outdated Property Data

If you find errors in ownership, property address, legal description or assessed value, contact the Brown County Auditor’s Real Estate Division. They can assist in:

- Requesting a correction to the property record

- Initiating a reappraisal if the valuation is inaccurate

- Ensuring that all updates are reflected in both online databases and official records

Taking prompt action helps maintain accurate property information, which is essential for taxes, legal matters, and real estate transactions.

2. Missing Parcel Information

Occasionally, some parcels especially older properties, subdivided lots, or unique parcels may not appear in online records. To verify these properties:

- Visit the Brown County Auditor’s Office in person

- Contact the Real Estate Division by phone or email

- Provide detailed property information such as parcel number, address, or legal description

Staff can help locate the correct records or guide you through requesting updated documentation.

3. Contacting Support

The Brown County Auditor’s Office provides multiple channels for assistance:

- Phone support during office hours

- Email inquiries to designated staff for specific property concerns

- In-person assistance for complex requests or certified document needs

This ensures property owners, buyers, and researchers can quickly resolve questions or issues with their property records.

Who Maintains Property Records in Brown County

The Brown County Auditor is the official authority responsible for maintaining all property information within the county. Responsibilities include:

- Appraising properties for tax purposes

- Recording ownership changes and property transfers

- Updating property information in public databases and online tools

- Ensuring easy public access to property records via the Auditor’s website and in-office services

By centralizing property record management, the Auditor’s Office guarantees accuracy, transparency, and accessibility for all residents, investors and interested parties in Brown County.

Why Property Records Are Important

Property records are essential for ensuring transparency and accuracy in real estate transactions. They allow property owners to verify their assessed value, enable buyers to confirm ownership details, and provide documentation needed for legal, financial, or tax purposes. Additionally, realtors, investors, and researchers use these records to study neighborhood trends, property values, and market dynamics within Brown County, Ohio. Access to comprehensive property information helps all parties make informed, confident decisions.

What Information Does a Property Record Contain?

A standard property record from the Brown County Auditor includes multiple sections that provide a detailed overview of a property:

Basic Property Details

- Owner Information: Full name and mailing address of the property owner

- Parcel Number: Unique identification code assigned to the property

- Property Address & Municipality: Exact location details

- School District & Taxing District Information: Determines applicable taxes and services

Property Value and Assessment Information

- Current market value and assessed value for taxation purposes

- Annual appraisal updates reflecting changes in property worth

- Breakdown of land and building values

- Valuation history for previous years to track changes

Tax Payment History

- Details of current and past tax bills

- Payment due dates and status of payments

- Millage rates applied by local authorities

- Information on delinquent or unpaid taxes, if applicable

Sale and Ownership History

- Previous owners and dates of ownership transfers

- Sale price and deed type for each transaction

- Official recording information for property transfers

Land and Building Specifications

- Lot size and zoning classification

- Year built, total area, and construction type

- Details of building improvements or structural modifications

A Brown County property record serves as a comprehensive resource for homeowners, potential buyers, investors and real estate professionals. By consolidating legal, financial, historical and physical property information, it ensures accurate decision-making, transparency and accountability in all property-related matters.

Types of Property Records Available in Brown County

The Brown County Auditor’s Office maintains a variety of property records, each designed to provide specific information for property owners, buyers, investors, and legal or financial professionals. Understanding the types of records available can help you access the information you need efficiently.

1. Property Tax Records

- Annual tax bills and payment status

- Applicable millage rates set by local authorities

- Delinquent or outstanding taxes

- Historical tax records for previous years

2. Property Ownership Records

- Full names and mailing addresses of owners

- Transfer dates and property sale details

- Official deed types and recording information

These records are essential for verifying legal ownership, researching property history, and facilitating real estate transactions.

3. Property Valuation Records

- Appraised market value

- Assessed value used for taxation

- Valuation history over previous years

- Breakdown of land vs. building value

These records are useful for property owners reviewing their taxes, investors assessing market value, or professionals performing financial or appraisal analysis.

4. Property Description and Building Records

- Lot size and zoning classification

- Year built, total area, and construction type

- Structural improvements or renovations

- Location within municipal or school districts

Property description and building records help buyers, architects, and real estate professionals understand the property’s characteristics, plan improvements, or assess compliance with local codes.

Helpful Tips Before Requesting a Property Record

- Always verify your parcel number or property address before searching records to avoid errors.

- Compare the Auditor’s data with your tax bill, mortgage statement or deed to ensure accuracy.

- Keep both digital and printed copies for personal reference, legal documentation, or financial planning.

Conclusion

Obtaining a property record copy from the Brown County Auditor is a simple and accessible process. Records can be retrieved online, by mail, or in person, providing critical information about ownership, property value, tax history and transaction details. Whether you are a property owner verifying details, a buyer researching a property, or a professional preparing for a sale or legal matter, the Auditor’s tools ensure accurate, up-to-date, and comprehensive information. Access to these records supports informed decision-making and promotes transparency in all property-related activities within Brown County.

FAQ’s

Can anyone access property records in Brown County?

Yes. Property records in Brown County are public information and can be accessed online, by mail, or directly through the Auditor’s Office.

Are property records free to view?

Yes. You can view and print property records for free using the Auditor’s online search portal. Fees apply only if you request certified copies.

How long does it take to receive a certified copy?

Certified copies are typically processed within 1–3 business days after the request is received, depending on the type of document and office workload.

What is the difference between assessed value and market value?

Market Value: The estimated selling price of the property on the open market.

Assessed Value: The value used for tax purposes, calculated by the Auditor’s Office based on local regulations and appraisal standards.

What is the Brown County Recorder property search map?

It is an online tool that allows users to find property details, ownership history and parcel maps within Brown County