Property taxes are manageable when paid on time, but overdue balances, interest and enforcement notices can quickly become stressful. Whether you own a home, manage rentals or research Brown County tax data, this guide explains the delinquent property tax process clearly.

The details here walk you through what the Brown County Delinquent Property Tax List actually contains, the common reasons parcels end up on it, where to access the most recent updated records, and the steps required to bring an account back into good standing

. You’ll also learn about payment extension programs, installment contracts offered through the Treasurer’s Office, possible fees, the documentation you may need, important deadlines, and the legal actions Brown County initiates when unpaid taxes keep growing without any repayment activity.

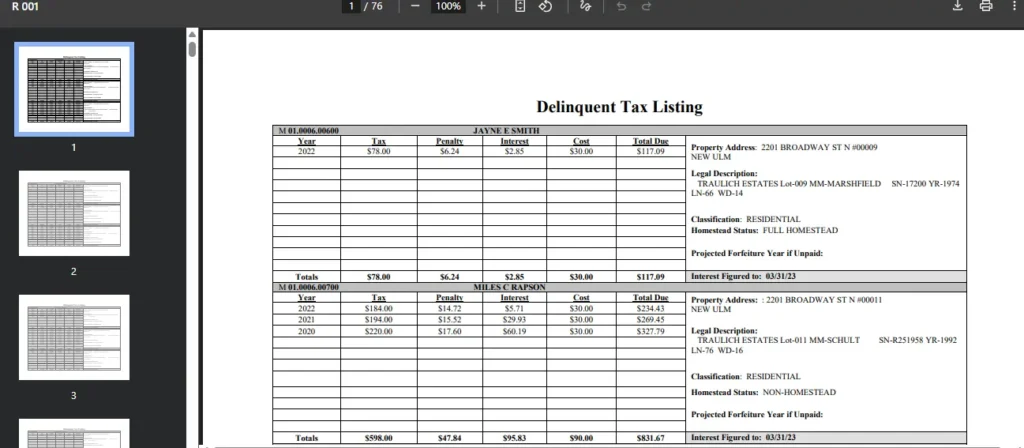

View the official Brown County Delinquent Property Tax List (PDF)

What Is the Brown County Delinquent Property Tax Roll?

The Brown County Delinquent Property Tax Roll is an official public record maintained by the Brown County Treasurer that identifies all parcels with unpaid property taxes past the legally required due date. Once a property owner misses the payment deadline and the balance remains outstanding after penalties are applied, the Treasurer classifies the parcel as delinquent and places it on this list. The record is publicly accessible and serves as the county’s formal documentation of overdue tax accounts.

Why Does Brown County Publish This List?

Brown County releases the delinquent tax roll for several reasons that support transparency and legal compliance:

- To notify the public of parcels carrying overdue property tax balances

- To begin the county’s formal collection, enforcement, and recovery process

- To identify parcels that may become eligible for tax lien sales or foreclosure actions if the debt continues to accumulate

- To meet Ohio’s open-records requirements, which mandate public access to delinquent tax information

The Treasurer generally updates the list each year, although certain sections may be refreshed more frequently when payment activity changes or new enforcement actions are initiated.

What Details Are Included in the Delinquent Tax Roll?

The Brown County Delinquent Property Tax Roll provides a full snapshot of every parcel with overdue taxes. The record usually includes:

| Information Included | Description |

|---|---|

| Property Owner Name | Legal owner listed on county records |

| Property Address | Physical location of the parcel |

| Parcel ID | Unique identifier assigned by Brown County |

| Tax Years Due | Specific years with unpaid balances |

| Penalties & Interest | Accrued charges on late taxes |

| Total Amount Owed | Full balance required to clear delinquency |

| Enforcement Status | Liens, certification, or foreclosure stage |

Because property tax information is considered public data under Ohio’s open-records law, all of these details can be accessed by anyone reviewing Brown County’s tax records.

Brown County Delinquent Property Tax Roll Explained

The Brown County Delinquent Property Tax Roll is an official public record maintained by the Brown County Treasurer. It lists all parcels with unpaid property taxes that have passed their legally required due dates. Once a property owner fails to pay on time and penalties are applied, the parcel is classified as delinquent and added to this list.

Properties typically become delinquent due to:

- Missing required payment deadlines – Brown County bills property taxes in two installments each year; failing to pay either installment on time can trigger delinquency.

- Ignoring notices from the Treasurer – The Treasurer sends mailed notices, certified letters, and sometimes digital alerts to remind owners of overdue balances.

- Accumulating unpaid taxes over multiple years – Unpaid taxes from previous years continue to accumulate, increasing penalties and interest, and may eventually lead to liens or foreclosure actions.

Why a Property Becomes Delinquent in Brown County

A parcel is marked delinquent in Brown County when the owner does not pay their required property taxes by the official deadlines. Several situations commonly push a property into delinquent status:

Missing Required Payment Deadlines

Brown County bills property taxes in two installments each year:

- First-half tax payment

- Second-half tax payment

Failing to pay either installment on time results in the account being flagged as delinquent once penalties are added.

Not Responding to Treasurer Notices

The Treasurer’s Office sends multiple reminders to help owners avoid delinquency, which may include:

- Mailed notices

- Certified warning letters

- Digital notifications depending on the county’s system

When these are ignored, the unpaid balance continues moving toward formal enforcement.

Allowing Taxes to Build Up Over Multiple Years

If overdue balances continue into additional tax years, the consequences get more serious. This can lead to:

- Significant penalties and interest accumulation

- Certification of delinquent taxes and placement of tax liens

- Eligibility for foreclosure or a sheriff’s sale if the owner takes no action

Brown County follows Ohio’s legal process for delinquent tax collection, meaning prolonged non-payment eventually becomes a legal matter, not just a billing issue.

What Happens if Your Name Appears on the Brown County Delinquent Property Tax Roll?

Having your parcel listed on the Brown County delinquent tax roll doesn’t mean the county is taking your home tomorrow, but it does set several formal steps into motion. Each stage increases the financial and legal pressure until the debt is resolved.

1. Penalties and Interest Begin Adding Up

Once a parcel goes delinquent, Brown County automatically applies late penalties and daily interest. The longer the balance sits unpaid, the larger the total becomes.

2. Certified Notices Are Mailed to the Owner

The Treasurer issues a series of official warnings that may include:

- A formal delinquency notice

- Certified letters outlining the overdue amount

- Notices describing the risk of a tax lien or future foreclosure action

These communications are legally required and give the owner a final chance to correct the issue before enforcement escalates.

3. Possible Tax Lien Sale

Ohio law allows counties to assign or sell delinquent tax debts to an authorized tax lien purchaser. If Brown County participates in a lien sale for certain delinquent parcels, the buyer gains the right to collect the overdue balance from the property owner, usually with additional interest.

4. Foreclosure Proceedings

If the delinquency continues for multiple years without any repayment agreement, the matter can be moved into the foreclosure process. This may involve:

- Referral to the Board of Revision for foreclosure review

- A potential Sheriff’s Sale if the debt is not resolved

Foreclosure is the county’s final enforcement option and takes time, but it becomes unavoidable when long-term tax debt goes unaddressed.

How to Get Removed from the Brown County Delinquent Tax Roll

The situation isn’t permanent. Once the overdue balance is taken care of or an approved repayment arrangement is in place, Brown County updates the property’s status and removes it from the next published delinquent roll.

1. Pay the Entire Outstanding Balance

When the full past-due amount is paid, including all added penalties and interest, the Treasurer updates the parcel to “paid” in the system. Your name is cleared from the delinquency list during the next scheduled update.

2. Enroll in a Payment Plan

The Brown County Treasurer may allow qualifying property owners to set up structured repayment plans, such as:

- Monthly installment agreements

- Multi-month repayment schedules

- Plans that factor in interest and remaining penalties

These options are helpful for owners dealing with financial setbacks and needing time to bring the account current.

3. Apply for Available Property Tax Relief Programs

Homestead Exemption

- Seniors 65+ and qualifying disabled homeowners

- Reduces taxable value of primary residence

CAUV (Current Agricultural Use Value)

- For qualifying farmland

- Taxes based on agricultural use, not market value

Owner-Occupancy Reduction

- Primary residence owners

- Small annual credit toward tax bill

Using one or more of these programs can lower future taxes and help prevent the property from falling back into delinquency again.

Required Forms & Documents in Brown County

Depending on how you choose to address delinquent property taxes in Brown County, you may need to provide different documentation:

| Situation | Required Documents |

|---|---|

| Payment Plan | Application form, photo ID, income proof (if requested) |

| Homestead Exemption | Ohio ID, age/disability proof, DTE 105A |

| CAUV Program | Agricultural use proof, CAUV renewal form |

| Public Records Request | Request form, parcel ID or address |

Fees Penalties and Additional Costs

Properties listed on the Brown County delinquent tax roll can incur a variety of extra charges if unpaid taxes remain outstanding:

- Late Fees: Applied automatically after the payment due date

- Interest Charges: Accumulate monthly until the full tax balance is settled

- Certified Mail Fees: Charged when the Treasurer sends official delinquency notices

- Tax Lien Costs: Additional fees if the county sells the lien to a third-party purchaser

- Foreclosure-Related Expenses: Legal, filing, and Sheriff Sale fees may apply in cases of long-term nonpayment

Brown County maintains transparency in all procedures, ensuring property owners can access detailed records, understand exact obligations, and explore relief options without confusion.

Can Real Estate Investors Use the Brown County Delinquent Property Tax Roll?

Yes. Investors regularly review Brown County’s delinquent tax roll because it highlights properties that may be financially distressed or at risk of enforcement. The list can help investors:

- Spot potential investment properties that may be undervalued

- Identify owners who might be open to selling due to mounting tax pressure

- Participate in tax lien assignments when the county offers them

- Track parcels that could eventually move into foreclosure procedures

That said, diving in blindly is a great way to create problems for yourself. Any investor using Brown County’s delinquency data should take time to study:

- Ohio’s tax foreclosure laws and county-level procedures

- Redemption timelines and repayment rights for owners

- Full due-diligence checks on the parcel, including title issues, zoning, land use, and outstanding liens

Conclusion

Understanding the Brown County Delinquent Property Tax Roll becomes much easier when you have clear, organized information in front of you. Whether you’re a homeowner trying to resolve overdue taxes or someone reviewing property records for research or investment, the details above walk you through the county’s rules, processes, required documents, fees, and available relief options. Brown County follows a structured system, and knowing how it works makes it far less stressful to manage delinquency issues or interpret public tax data

FAQ’s

How often is the Brown County delinquent tax roll updated?

Brown County typically releases the full delinquent list once a year, but internal records may be refreshed more frequently as payments are processed.

Is this information publicly accessible?

Yes. Property tax data in Ohio is classified as public information, so anyone can review it through the Treasurer or Auditor.

How long does it take to remove my name after payment?

Your parcel is usually cleared during the next official update, though the online tax system often reflects payments sooner.

Can I lose my home over delinquent taxes?

Yes, but only after several years of nonpayment and repeated certified notices. Foreclosure is the final step in Ohio’s legal process, not the starting point.

Can I pay my delinquent Brown County taxes online?

Yes. Brown County allows secure online payments through the Treasurer’s website, where you can review your balance and pay past-due amounts.