Many homeowners in Brown County feel overwhelmed when they receive their property tax assessment notice. The assessed value can seem confusing, and the numbers often don’t match what you believe your property is worth. Filing a property tax valuation appeal might feel intimidating, but with a clear roadmap, proper preparation, and understanding of local rules, you can challenge your assessment effectively and potentially reduce your tax burden.

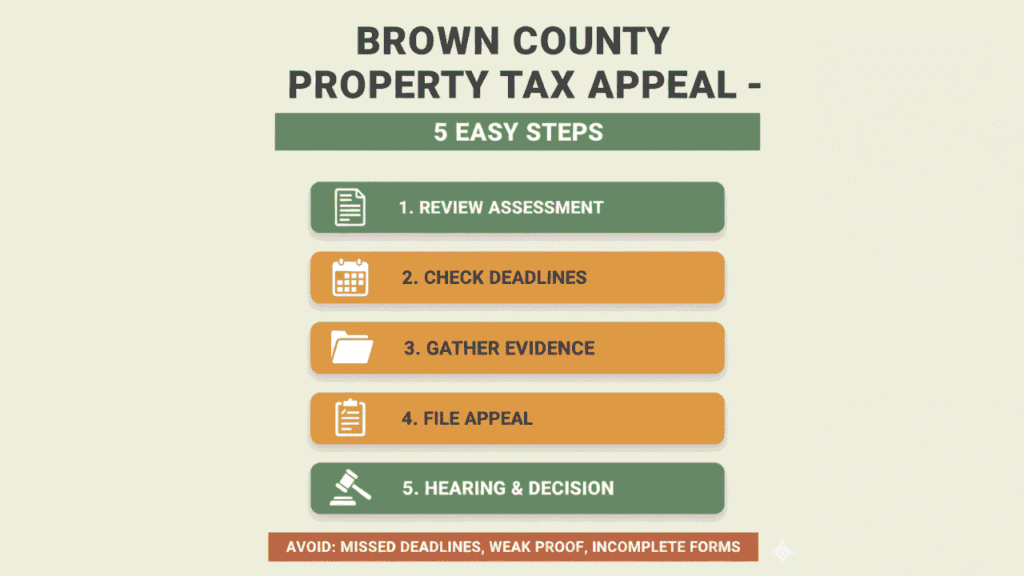

This guide walks you through every step of the property tax appeal process in Brown County, explains what forms are required, shows you how to gather evidence, clarifies deadlines, and provides practical tips for a successful appeal. By the end, you’ll feel confident in managing your property tax dispute.

Confusing Property Tax Assessment Process

One of the first challenges is understanding how your Brown County property tax was calculated. Many homeowners receive an assessment notice but cannot decipher the valuation formula or why their property value changed from previous years.

Start by reviewing your assessment notice carefully. The assessed value explanation often includes land value, building value, and improvements. Comparing this with prior years and similar properties in your neighborhood can give you a clear idea of whether your property is overvalued.

Lack of Guidance on Filing an Appeal

Most residents don’t know where to start with an appeal. The process may seem bureaucratic, with multiple forms and procedures.

In Brown County, you’ll need the official property tax appeal form provided by the Brown County Tax Board. The county website usually provides detailed filing instructions, including which forms to submit, how to submit them (mail, in-person, or online), and what supporting documentation is required.

Unclear Deadlines for Appeals

Missing the appeal window can cost thousands in overpaid taxes. Unfortunately, many homeowners are unsure of the exact appeal deadline or timeline.

Brown County sets a tax protest period each year, typically shortly after assessment notices are mailed. Check the official county assessor’s calendar to confirm your specific filing timeline and submit your appeal before the deadline to ensure it is considered.

Difficulty Gathering Evidence

A major pain point is collecting enough evidence to support your appeal. Homeowners often struggle to find comparable property sales, appraisals, or other documentation to demonstrate overvaluation.

Start by gathering recent sales of similar homes in your neighborhood, appraisal reports, photographs of your property, and any unique features that might affect value. Organizing this property evidence in a clear, concise format makes it easier for the board to understand your argument.

Complexity of Tax Law and Regulations

Understanding local Brown County tax code, exemptions, and valuation rules can be overwhelming. Many homeowners feel lost navigating property tax laws, exemptions for seniors or veterans, and how rules impact your assessed value.

Consider reviewing local tax statutes and county guidelines, or even consulting with a property tax professional. Being familiar with property tax laws, valuation rules, and available exemptions allows you to challenge assessments confidently and effectively.

High Stress and Uncertainty

Appealing your property tax can be stressful. Homeowners often worry about penalties, overpaying, or the appeal outcome.

Managing stress starts with being organized. Document everything, know your deadlines, and understand the steps in the process. Preparing thoroughly reduces anxiety and ensures you present your case clearly to the Brown County Tax Board.

Limited Communication from Tax Office

Many users report slow or unclear responses from the assessor’s office or the appeal board. Miscommunication can lead to missed deadlines or incomplete submissions.

Keep a log of all correspondence and phone calls with the county assessor or tax office. Knowing who to contact and when helps maintain official correspondence and ensures your appeal stays on track.

Fear of Rejection or Additional Fees

Some homeowners worry that filing an appeal might backfire or result in extra costs. There is always a small risk of rejection or additional charges if forms are incomplete or submitted incorrectly.

Following official appeal instructions, providing sufficient evidence, and meeting all deadlines minimizes the risk of a rejected appeal. Most appeals that are prepared carefully have a strong chance of success without incurring extra fees.

Time-Consuming Process

Appealing your property tax can take several weeks or months. From gathering documentation, submitting forms, attending hearings, and awaiting board decisions, the process can feel long.

Understanding the appeal timeline, hearing schedule, and the tax review process in Brown County helps you plan accordingly. Breaking the process into steps and using a checklist ensures you stay organized and avoid unnecessary delays.

Lack of Local Expertise

Many homeowners don’t know local property trends or Brown County real estate practices, which can make challenging valuations harder.

Research neighborhood values, recent property comparables, and local market trends. Knowing the local market allows you to provide evidence that accurately reflects your property’s fair market value.

Step-by-Step Property Tax Appeal Checklist

- Review your assessment notice carefully

- Collect property evidence (appraisals, comparable sales, photos)

- Check exemptions and reductions you may qualify for

- Complete the official property tax appeal form

- Submit the appeal before the deadline

- Attend any required tax board hearings

- Track your appeal’s progress through the county assessor’s office

This checklist ensures no step is overlooked and improves the chance of a successful appeal.

Property Tax Appeal Comparison Table

| Aspect | Purpose | Responsible Office |

|---|---|---|

| Assessment Review | Understand property value calculation | Brown County Assessor |

| Evidence Collection | Support your appeal | Homeowner / Appraiser |

| Filing Appeal | Official submission of appeal | Brown County Tax Board |

| Hearing | Present your case | Tax Appeal Board |

| Final Decision | Adjust assessment or confirm value | Tax Board / Assessor |

This table summarizes key steps, responsibilities, and goals, making the appeal process clear for homeowners.

Real-Life Scenario

A Brown County homeowner received a property assessment that was significantly higher than the sale price of similar nearby homes. Uncertain how to appeal, they delayed submitting forms, gathered insufficient evidence, and missed the initial hearing. Their appeal was initially rejected, resulting in continued overpayment. Later, by following the checklist above, collecting proper comparables, and filing a timely appeal, they successfully reduced their assessed value, saving hundreds in property taxes.

Key Takeaways

- Review your assessed value explanation carefully.

- Know your appeal deadline and submit on time.

- Gather strong property evidence like comparables and appraisal reports.

- Follow Brown County property tax laws and understand exemptions.

- Use checklists to stay organized and avoid mistakes.

- Communicate clearly with the assessor and tax board.

- Attend hearings prepared to present your case effectively.

Conclusion

Appealing your property tax valuation in Brown County may seem complex, but by understanding the assessment process, gathering proper evidence, meeting deadlines, and following official procedures, homeowners can confidently challenge their property’s value. Using checklists, preparing for hearings, and knowing local exemptions ensures a smoother appeal process, reduces stress, and increases the likelihood of a favorable outcome.

FAQs

Q: Can I appeal my Brown County property tax every year?

A: Yes, appeals can be submitted each year, but you must meet the county’s filing deadlines.

Q: What evidence helps my appeal succeed?

A: Comparable property sales, appraisals, photos, and documentation of property issues strengthen your case.

Q: Are there exemptions for seniors or veterans?

A: Yes. Brown County offers exemptions for certain groups, which can reduce assessed value or tax liability.

Q: How long does the appeal process take?

A: Typically a few weeks to several months, depending on documentation and hearing schedules.

Q: Who can I contact for help?

A: The Brown County Assessor and Tax Appeal Board provide guidance and official instructions.