Property taxes can feel confusing and unpredictable, especially if you own property, plan to buy a home, or invest in real estate in Brown County, Ohio. Our Brown County Property Tax Calculator 2025 is designed to make this process simple and transparent. Using this tool, you can estimate your annual property taxes, plan your budget with confidence, and better understand your potential tax obligations. Whether you’re reviewing your current tax bill or evaluating a future purchase, this calculator provides reliable estimates based on recent Brown County Auditor property data.

Brown County Auditor Tax Calculator

2024 Property Tax Estimator – Brown County, Ohio

- Use this calculator to estimate 2024 property taxes payable in 2025.

- Enter your property value and select the appropriate options to calculate an estimated tax amount for Brown County.

- This calculator provides an estimate only. Final tax bills are issued by the Brown County Treasurer.

Calculator Inputs

- Appraised Value

- Property Located In (Tax District)

- Property Type

- Residential / Agricultural

- Commercial / Industrial

- Reductions

- Owner Occupancy Credit

- Homestead Reduction

Download Brown County Property Tax PDF

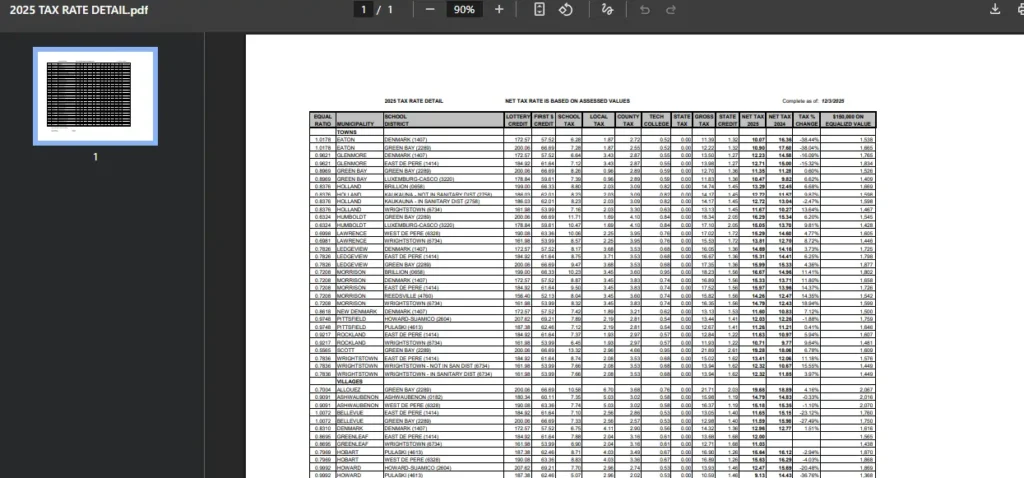

For detailed information on property tax rates, levies, exemptions and official notices, you can download the Brown County property tax PDF. This document is helpful for homeowners, buyers and investors who want to verify calculations, understand tax reductions and review official county data.

Download brown county tax rates pdf

How to Use the Brown County Tax Calculator

Estimating property taxes in Brown County is easy with this step-by-step guide.

Enter Property Value

Start by entering the appraised value of your property. This value is determined by the Brown County Auditor and represents the county’s assessed market value for tax purposes. Entering the correct appraised value ensures the tax estimate closely reflects what you may actually owe for the year.

Select Tax District

Brown County is divided into multiple tax districts, each with its own millage rates and levies. Property taxes can vary depending on school districts, townships, and municipalities. Select the correct tax district for your property, which can be found on your tax bill or through the Brown County property search system.

Choose Property Type

Select whether your property is residential/agricultural or commercial/industrial. Property classification affects tax rates and eligibility for reductions. Residential properties may qualify for credits that commercial properties do not, so choosing the correct type is important for an accurate estimate.

Apply Reductions

Some property owners qualify for tax reductions, such as the owner-occupancy credit or homestead exemption. These reductions can significantly lower your property tax bill. Apply any eligible reductions in the calculator to see a more realistic estimate of your final tax obligation.

Understanding Your Estimated Property Taxes

After entering your information, the calculator generates an estimated tax result. Here’s how it works and what the numbers mean.

How the Calculator Works

The Brown County Property Tax Calculator uses recent Brown County Auditor data, including appraised values, tax rates, levies and applicable credits. It factors in school district taxes, township levies and local rates automatically, giving you a dependable estimate without complex manual calculations.

When Property Taxes Are Payable

This calculator estimates 2024 property taxes payable in 2025. Actual payment schedules and due dates are set by the Brown County Treasurer. Because property values and tax rates may change each year, it’s a good idea to revisit your estimate annually.

Brown County Tax Calculator Results Explained

After calculation, you’ll see a breakdown of your estimated property taxes. Here’s what each result means:

Appraised Value

This is the official value of your property as recorded by the Brown County Auditor. It represents the market value used for tax calculations.

Assessed Value

In Ohio, property taxes are based on 35% of the appraised value.

For example, a property appraised at $1,000,000 would have an assessed value of $350,000.

Mills Used

“Mills” represent the tax rate charged per $1,000 of assessed value. This rate includes school district taxes, local levies, and municipal charges. Higher millage rates result in higher property taxes.

Tax Before Credits

This is the estimated tax amount before applying any reductions or exemptions. It shows the full tax liability based on value and tax rates alone.

Owner-Occupancy Credit Applied

If the property is your primary residence and qualifies, this credit reduces your tax amount. If not eligible, this value will be $0.00.

Homestead Reduction Applied

The homestead reduction applies to qualifying homeowners, often seniors or disabled individuals. If approved through the county, this credit lowers your taxable amount.

Estimated Tax Due

This is the final estimated property tax after applying any eligible credits. This is the amount you can use for budgeting and financial planning purposes.

Benefits of Using the Brown County Property Tax Estimator

Using this tax calculator offers several advantages:

- Fast and easy property tax estimates

- Better budgeting for homeowners and investors

- Reduced errors compared to manual calculations

- Improved decision-making when buying or selling property

- Clear understanding of Brown County tax obligations

Common Questions About Brown County Property Taxes

Can I rely on the calculator’s estimate?

The calculator uses official Brown County Auditor data and current tax rates. While estimates are accurate, final tax bills may vary due to reassessments or new levies.

What if my property value changes?

If your property is reassessed or improved, enter the updated appraised value to receive a revised tax estimate.

How do I apply for tax reductions?

Tax reductions such as homestead exemptions and owner-occupancy credits must be applied for through the Brown County Auditor’s Office. Once approved, you can apply them in the calculator.

Conclusion

Understanding property taxes in Brown County doesn’t have to be overwhelming. The Brown County Property Tax Calculator 2025 gives homeowners, buyers, and investors a simple and reliable way to estimate taxes, plan finances, and avoid surprises. Use this tool as a guide, and always confirm official amounts through the Brown County Treasurer for final billing details.

FAQs

What is the Brown County Property Tax Calculator?

It’s an online tool that estimates annual property taxes using appraised value, tax district, property type, and eligible reductions.

How accurate are the estimates?

Estimates are based on recent Brown County Auditor data and current tax rates. Actual tax bills may vary slightly.

Can I use this calculator for commercial properties?

Yes. The calculator supports residential, agricultural, commercial, and industrial property types.

When are Brown County property taxes due?

Estimated 2024 taxes are generally payable in 2025. Exact due dates are set by the Brown County Treasurer.

What if my tax bill looks different from the estimate?

Differences may occur due to reassessments, levy changes, or eligibility for credits. Always refer to your official tax bill for final amounts.