Owning property in Brown County isn’t just about maintaining your house it also means keeping up with your annual tax obligations. For many residents especially seniors, veterans, homeowners with disabilities, and families living on limited income, those tax bills can feel like they’re chewing through the budget faster than anyone would like.

Brown County offers multiple property tax relief and exemption programs to help ease that pressure and keep long-term homeownership realistic. These programs are created under Ohio law but administered locally, and each one has its own qualifications, documentation rules, and review process. Below is a clear, updated breakdown of who may qualify, how the application works, and the key deadlines you need to watch so you don’t miss out on savings you’re entitled to.These programs can reduce your annual tax bill significantly sometimes by hundreds or even thousands of dollars.

Understanding Property Tax Relief in Brown County

Property tax relief in Brown County refers to financial assistance programs that reduce or remove a portion of your yearly property tax responsibility. These initiatives fall into two primary types:

- Reduction: A decrease in the amount of property taxes you are required to pay.

- Exemption: A full or partial removal of your property’s taxable value, which directly lowers your tax bill.

In Brown County, these programs are managed by the Brown County Auditor’s Office, which follows state guidelines to provide support for eligible residents. The goals are straightforward, help seniors, disabled homeowners, qualifying veterans, and households with limited income stay in their homes without facing overwhelming tax pressure. The county reviews each application carefully to ensure residents who genuinely need assistance receive meaningful and sustainable relief.

Main Types of Property Tax Reductions and Exemptions in Brown County

Brown County provides several tax relief options designed to support homeowners who face financial strain due to rising property values and fixed household budgets. Each program serves a different group of residents, so identifying the one that matches your situation is the first step toward lowering your annual tax bill.

Homestead Exemption

The Homestead Exemption remains the most commonly used property tax relief program in Brown County. It offers meaningful savings for seniors, qualifying disabled homeowners, and eligible surviving spouses who rely on stable monthly expenses.

Who Can Apply

- Homeowners who are 65 years of age or older during the filing year

- Individuals who are permanently and totally disabled

- Surviving spouses of applicants who previously qualified

- The property must be your primary, owner-occupied residence

Benefits

- Reduces the taxable value of your home by up to $25,000

- Example: If your home is valued at $110,000, county taxes would apply to $85,000 instead of the full value

- Savings appear automatically on your tax bill after approval

Documents You’ll Need

- A valid photo ID or proof of age

- Disability verification from a licensed professional (if applying under disability status)

- Proof of household income to meet Ohio’s annual income threshold

- A completed Brown County Homestead Exemption Application (Ohio Form DTE 105A)

How to Apply

- Go to the Brown County Auditor’s website and download the current Homestead application.

- Fill out the form carefully and include all required documentation.

- Submit your application by mail or in person to the Brown County Auditor’s Office.

- Once your application is accepted, the exemption typically continues each year without additional paperwork unless state eligibility rules change.

Download Homestead Exemption Application for Rev. 10/19 Disabled Veterans and Surviving Spouses

Disabled Veterans Exemption

Brown County offers a dedicated property tax exemption for veterans who are rated 100% disabled due to service-connected conditions. This program provides some of the strongest tax relief available in Ohio and is intended to support those who sacrificed their health in military service.

Who Can Apply

- Honorably discharged veterans with a 100% service-connected disability rating from the U.S. Department of Veterans Affairs

- Surviving spouses of eligible veterans, as long as they remain in the same primary residence

Benefits

- Removes a substantial portion of the home’s taxable value

- For many qualified applicants, the exemption can wipe out the entire property tax bill on their owner-occupied residence

- Relief begins once the county auditor completes verification of eligibility

Required Documents

- Official VA disability rating letter confirming 100% service-connected disability

- DD-214 or comparable proof of honorable military service

- A fully completed Brown County Disabled Veterans Exemption Application (Ohio Form DTE 105I)

How to Apply

- Visit the Brown County Auditor’s website and download the current Disabled Veterans Exemption form.

- Attach the VA disability documentation and military service proof.

- Submit your completed application and paperwork directly to the Brown County Auditor’s Office for review.

- After approval, the exemption applies exclusively to your primary, owner-occupied residence, and remains active as long as you maintain eligibility.

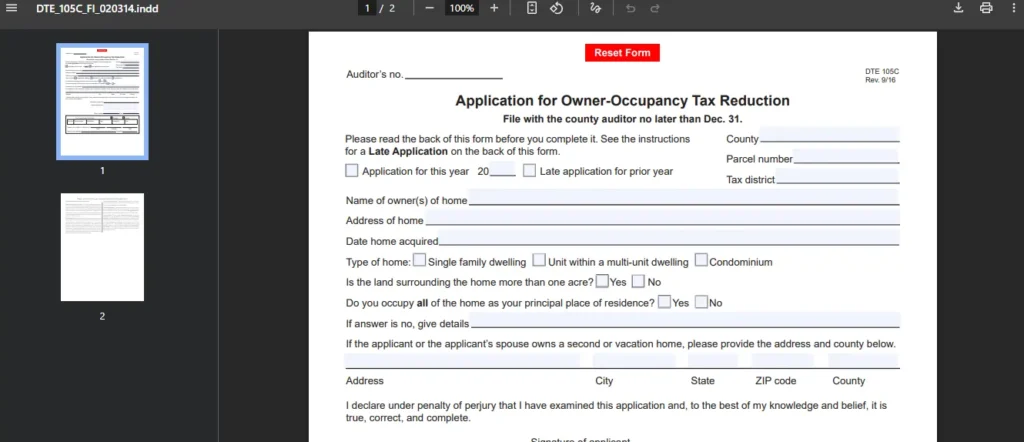

Owner-Occupancy Tax Reduction

The Owner-Occupancy Tax Reduction is a straightforward but useful savings program offered in Brown County. It provides a small percentage discount for homeowners who actually live in the property they own, helping reduce yearly tax costs on primary residences.

Who Can Apply

- The home must be owner-occupied as of January 1 of the tax year

- The program applies only to residential, primary-use properties

- The owner must be listed on the deed and live at the same address

Benefits

- Grants a 2.5% reduction on the portion of your tax bill tied to the home’s taxable value

- Savings automatically show on future tax statements once the county approves your application

Documents Required

- Proof of ownership, such as a recorded deed or property title

- Proof of residency, like a driver’s license, utility bill, or voter registration with the matching address

- A completed Brown County Owner-Occupancy Application (Ohio Form DTE 105C)

How to Apply

- Visit the Brown County Auditor’s website and download the Owner-Occupancy Reduction application.

- Fill out the form accurately and attach the required ownership and residency documents.

- Submit the application in person or by mail to the Brown County Auditor’s Office.

- After approval, the reduction stays on your record automatically as long as you continue owning and living in the home.

Download Owner-Occupancy Tax Reduction Form

Nonprofit or Religious Property Exemption

Brown County offers a property tax exemption for organizations that use their property exclusively for religious, charitable, educational, or public-benefit purposes. This program ensures that qualifying nonprofits can direct more of their resources toward community services rather than property taxes.

Who Can Apply

- Churches, schools, and IRS-recognized nonprofit organizations

- Properties that are actively used for religious worship, charitable operations, or educational programs

Benefits

- May grant a full exemption from property taxes, depending on how the property is used

- Offers long-term savings for organizations that meet state-defined public service criteria

Documents Required

- IRS 501(c)(3) determination letter or comparable nonprofit status proof

- Evidence of ownership such as a recorded deed

- A detailed written explanation of how the property is used for religious, charitable, or educational purposes

- Application submitted through the Ohio Department of Taxation, with copies provided to Brown County

How to Apply

- Download the exemption application from the Ohio Department of Taxation.

- Prepare all required documentation and complete the full application packet.

- Submit it to the Ohio Department of Taxation, and provide a copy to the Brown County Auditor’s Office for local review.

- Approval is based on state standards and verification of actual property use.

Step-by-Step Process to Apply for Property Tax Relief in Brown County

Applying for tax relief in Brown County is straightforward when you follow the correct process and have all required documentation ready.

1. Identify Which Program Fits Your Situation

Review the eligibility criteria for each Brown County property tax program:

- Homestead Exemption

- Disabled Veterans Exemption

- Owner-Occupancy Reduction

- Nonprofit or Religious Property Exemption

Choosing the right program from the start prevents delays and ensures you submit the correct paperwork.

2. Collect Required Documents

Gather all supporting materials before beginning the application. These may include:

- Government-issued ID

- Proof of age or residency

- Income documentation (if required for Homestead)

- Medical documentation for disability claims

- Military service paperwork for veterans

- IRS nonprofit verification for organizations

Having everything ready helps avoid processing holdups.

3. Complete the Correct Application Form

Use the official forms required for Brown County:

- Homestead Exemption → Ohio DTE 105A

- Disabled Veterans Exemption → Ohio DTE 105I

- Owner-Occupancy Reduction → Ohio DTE 105C

Fill out the forms accurately and attach all required documents to support your eligibility.

4. Submit Your Application

Submit your completed application and attachments to the Brown County Auditor’s Office, either by mail or in person.

Address: Brown County Auditor’s Office, 800 Mt. Orab Pike, Georgetown, OH 45121

Check your packet carefully to ensure nothing is missing.

5. Wait for Review

The Auditor’s Office will review your submission and notify you by mail once a decision is made.

Some programs may require additional follow-up documentation, so keep copies of everything for reference.

6. Renew if Needed

Many property tax programs in Brown County renew automatically each year. However, you should verify your eligibility annually.

If your income, residency, disability rating, or property status changes, you must update your information to continue receiving relief. Failure to update changes can result in loss of the exemption.

Helpful Resources for Homeowners in Brown County

- Brown County Auditor’s Office – Brown County Auditor

- Access current forms, instructions, deadlines, and official guidance for all property tax reduction and exemption programs.

- Ownwell Property Tax Estimator – ownwell.com

- Estimate potential savings based on your home’s value and your eligibility for various Ohio property tax relief programs.

- Ohio Department of Taxation – tax.ohio.gov

- Learn more about statewide tax exemptions, credits, and property valuation policies that apply to Brown County residents.

- Legal Aid of Southwest Ohio

- Provides free assistance for seniors, veterans, and low-income homeowners who need help with applications or documentation for tax relief programs.

Common Mistakes to Avoid

Many applicants in Brown County lose out on tax savings simply because of avoidable errors. Keeping an eye on these common mistakes can save you time and prevent your application from being delayed or rejected:

- Missing program deadlines. Each property tax program may follow a different filing schedule, so confirm dates with the Brown County Auditor before submitting anything.

- Leaving out essential documents. Missing proof of age, income, disability status, residency or ownership is one of the most common reasons applications get held up.

- Using the wrong form. Every exemption has its own state-issued form, and submitting the incorrect one will prevent the Auditor’s Office from processing your request.

- Assuming your benefit renews automatically. Some programs continue each year, but others require updated information. Always verify your status rather than assuming the reduction will stay in place on its own.

Why Applying Matters in Brown County

Seeking property tax reductions or exemptions in Brown County is not just a way to lower your tax bill it’s a strategy to safeguard your home and strengthen your financial security.

These programs are specifically structured to assist seniors, veterans and homeowners facing high property taxes, helping residents keep housing affordable and manageable.

Many Brown County homeowners benefit significantly each year, often saving hundreds or even thousands of dollars, simply by submitting the proper applications and meeting eligibility requirements.

Conclusion

Applying for a property tax reduction or exemption in Brown County empowers homeowners to better manage their yearly tax responsibilities. By carefully reviewing eligibility criteria, gathering all necessary documentation beforehand, and submitting applications accurately and promptly, residents can unlock substantial savings. Taking these steps not only helps reduce immediate tax bills but also supports long-term financial planning and stability, ensuring you make the most of the relief programs available in Brown County.

FAQs

Brown County Homestead Exemption Form

Seniors and homeowners with permanent disabilities can apply to lower property taxes on their primary residence. The form is available through the Brown County Auditor’s Office or directly on their official website.

Owner-Occupancy Tax Reduction in Brown County

Homeowners who live in their own property may qualify for a reduction of up to 2.5% on their annual property taxes. This benefit stays in effect as long as the home remains owner-occupied.

Brown County Property Tax Increases

Property taxes can rise due to increases in property valuations or the introduction of new local levies. You can review your current property tax bill or file an appeal using the Brown County Auditor’s online Property Search and Records portal.

Home Exemption for Property Taxes

This program lowers the taxable value of your primary home, reducing yearly property tax obligations. It is primarily designed for seniors, disabled homeowners, and veterans who meet eligibility criteria.

Property Tax Homestead Credit in Brown County

Eligible homeowners can reduce property taxes by excluding a portion of their home’s assessed value. This credit provides consistent annual savings for seniors, permanently disabled residents, and qualifying veterans in Brown County.